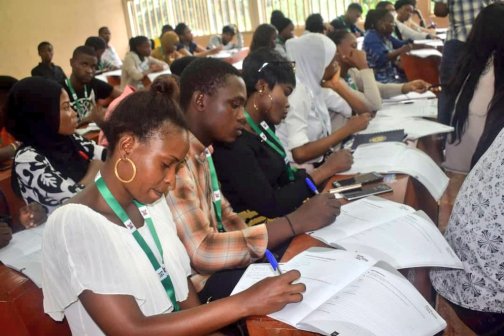

In a move towards enhancing the education sector, President Bola Ahmed Tinubu signed the Student Loan Bill into law on Monday. 9jahotvibes reports that this legislation aims to grant interest-free loans to financially disadvantaged Nigerian students, unlocking an opportunity for higher education for them. Read Full Story >>>

![All You Need to Know About the Student Loan Bill Signed by Tinubu [DETAILS]](https://9jahotvibes.com/wp-content/uploads/2023/06/All-You-Need-to-Know-About-the-Student-Loan-Bill.jpg)

The news comes as a welcome relief for students, particularly in light of recent fee hikes announced by some institutions, including Federal Government-owned universities. It is believed that the introduction of the student loan bill will alleviate the difficulties faced by students in financing their tertiary education.

Applying for the loan facility is a straightforward process. According to the bill’s provisions, students seeking loans under this Act must apply to the Bank Chairman through their respective institutions, provided they meet the following conditions:

i. The student must have secured admission into a public Nigerian University, Polytechnic, college of education, or any TVET school.

ii. The applicant’s income or family income must be less than N500,000 per annum.

iii. The applicant must provide at least two civil servants as guarantors: either individuals serving at a minimum of level 12 for at least twelve years, a Lawyer with at least ten years of post-call experience, a Judicial officer, or a Justice of Peace.

Students who have defaulted on previous loans or have been found guilty of exam malpractice, felony, or drug offences will not be considered. Additionally, applicants whose parents have defaulted on previous loans will also be excluded from eligibility.

Once the above conditions are met, loan applications will be submitted through the Students Affairs Office of each institution. The submission should include a list of all qualified applicants from the institution, accompanied by a cover letter signed by the Vice-Chancellor, Rector, or head of the institution, along with the Student Affairs department.

Regarding repayment, the act stipulates that “Any beneficiary of the loan to which this Act refers shall commence repayment two years after completion of the National Youth Service Corps program.” Repayment will be facilitated by deducting 10 percent of the beneficiary’s salary at the source by their employer.

Self-employed individuals who are loan beneficiaries must remit 10 percent of their total monthly profit to the designated student loan account, as prescribed by the bank.

To ensure compliance, a self-employed person must submit all relevant information within 60 days of assuming that status, including business name, address, location, registration documents, registered bankers, partner names, and names of directors and shareholders to the Commission.

Any individual found to be in default of the provisions mentioned above or aiding such default will be deemed guilty of an offence. If convicted, they may face imprisonment for two years, a fine of N500,000, or both penalties.

![Omo-Agege, Keyamo, Oyetola, Others Hustle for Ministerial Appointments [DETAILS]](https://9jahotvibes.com/wp-content/uploads/2023/06/Omo-Agege-Keyamo-Oyetola-Others-Hustle-for-Ministerial-Appointments-DETAILS.jpeg)